Special Events Gaap . some popular types of special events include, but are not limited to: hosting an auction, gala, marathon, golf event? however, accounting for special events can be tricky from a gaap and a tax point of view. if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. While fundraising is an integral part of many nonprofits’ finances, accounting for these. Special events, in this context, are synonymous with fundraising events such as galas (most. if your nonprofit follows generally accepted accounting principles (gaap), special event revenue should be reported on financial statements. federal tax issues.

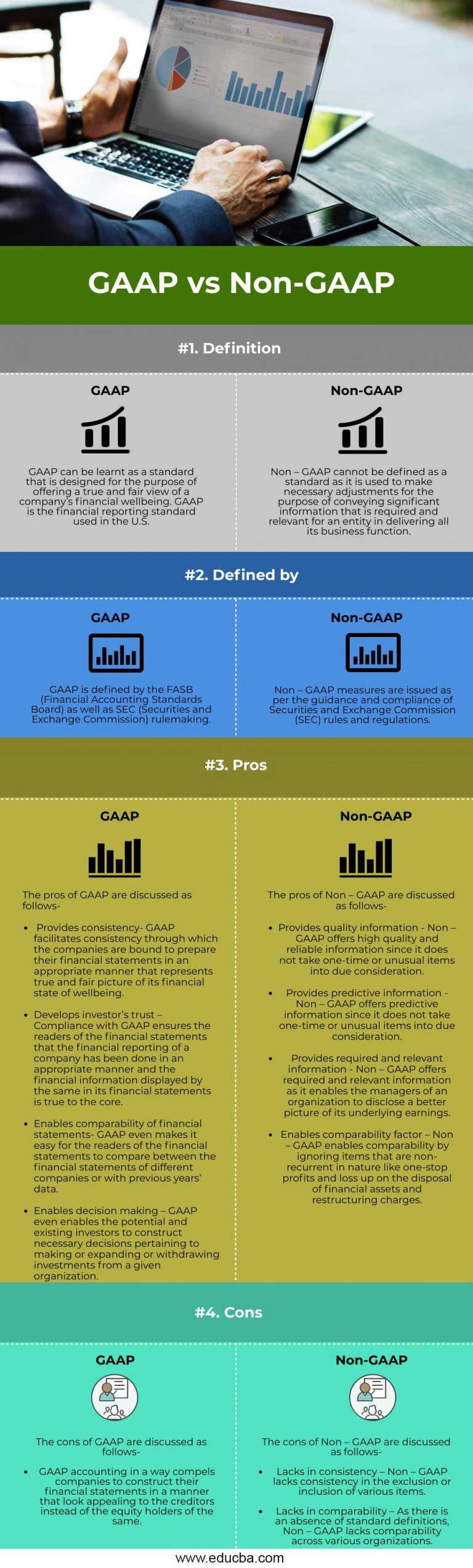

from www.educba.com

if your nonprofit follows generally accepted accounting principles (gaap), special event revenue should be reported on financial statements. federal tax issues. however, accounting for special events can be tricky from a gaap and a tax point of view. Special events, in this context, are synonymous with fundraising events such as galas (most. if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. some popular types of special events include, but are not limited to: hosting an auction, gala, marathon, golf event? While fundraising is an integral part of many nonprofits’ finances, accounting for these.

GAAP vs NonGAAP Top 4 Differences to Learn with Infographics

Special Events Gaap hosting an auction, gala, marathon, golf event? however, accounting for special events can be tricky from a gaap and a tax point of view. While fundraising is an integral part of many nonprofits’ finances, accounting for these. some popular types of special events include, but are not limited to: Special events, in this context, are synonymous with fundraising events such as galas (most. if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. if your nonprofit follows generally accepted accounting principles (gaap), special event revenue should be reported on financial statements. federal tax issues. hosting an auction, gala, marathon, golf event?

From builtin.com

What Is GAAP? (Definition, 10 Principles, Compliance) Built In Special Events Gaap if your nonprofit follows generally accepted accounting principles (gaap), special event revenue should be reported on financial statements. hosting an auction, gala, marathon, golf event? federal tax issues. Special events, in this context, are synonymous with fundraising events such as galas (most. however, accounting for special events can be tricky from a gaap and a tax. Special Events Gaap.

From www.flickr.com

Government as a Platform (GaaP) Event Live demo of Data … Flickr Special Events Gaap Special events, in this context, are synonymous with fundraising events such as galas (most. some popular types of special events include, but are not limited to: if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. hosting an auction, gala, marathon, golf event? federal tax issues. however, accounting for special. Special Events Gaap.

From www.youtube.com

What Is GAAP? Explained. CPA Exam and Intermediate Accounting. YouTube Special Events Gaap some popular types of special events include, but are not limited to: Special events, in this context, are synonymous with fundraising events such as galas (most. hosting an auction, gala, marathon, golf event? federal tax issues. however, accounting for special events can be tricky from a gaap and a tax point of view. if your. Special Events Gaap.

From www.akounto.com

GAAP Overview & Key Accounting Principles Akounto Special Events Gaap federal tax issues. however, accounting for special events can be tricky from a gaap and a tax point of view. if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. While fundraising is an integral part of many nonprofits’ finances, accounting for these. some popular types of special events include, but. Special Events Gaap.

From www.studocu.com

US GAAP vs IFRS Liabilities and Special Topics U GAAP vs IFRS Liabilities and Related Special Events Gaap some popular types of special events include, but are not limited to: hosting an auction, gala, marathon, golf event? if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. Special events, in this context, are synonymous with fundraising events such as galas (most. While fundraising is an integral part of many nonprofits’. Special Events Gaap.

From efinancemanagement.com

Extraordinary Items Under GAAP All You Need To Know Special Events Gaap if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. hosting an auction, gala, marathon, golf event? however, accounting for special events can be tricky from a gaap and a tax point of view. some popular types of special events include, but are not limited to: Special events, in this context,. Special Events Gaap.

From www.gaaporphanage.org.uk

Events at GAAP Gaap Orphanage Special Events Gaap While fundraising is an integral part of many nonprofits’ finances, accounting for these. however, accounting for special events can be tricky from a gaap and a tax point of view. if your nonprofit follows generally accepted accounting principles (gaap), special event revenue should be reported on financial statements. hosting an auction, gala, marathon, golf event? federal. Special Events Gaap.

From dxokflcpm.blob.core.windows.net

Good Names For Home Account at Marilyn Rose blog Special Events Gaap however, accounting for special events can be tricky from a gaap and a tax point of view. hosting an auction, gala, marathon, golf event? While fundraising is an integral part of many nonprofits’ finances, accounting for these. if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. some popular types of. Special Events Gaap.

From www.gaaporphanage.org.uk

Events at GAAP Gaap Orphanage Special Events Gaap Special events, in this context, are synonymous with fundraising events such as galas (most. however, accounting for special events can be tricky from a gaap and a tax point of view. if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. hosting an auction, gala, marathon, golf event? While fundraising is an. Special Events Gaap.

From accountingresourcesinc.com

GAAP and Why It's Important Accounting Resources Inc Special Events Gaap some popular types of special events include, but are not limited to: hosting an auction, gala, marathon, golf event? if your nonprofit follows generally accepted accounting principles (gaap), special event revenue should be reported on financial statements. federal tax issues. Special events, in this context, are synonymous with fundraising events such as galas (most. if. Special Events Gaap.

From studylib.net

Major Differences between US GAAP and IFRS Special Events Gaap however, accounting for special events can be tricky from a gaap and a tax point of view. While fundraising is an integral part of many nonprofits’ finances, accounting for these. federal tax issues. some popular types of special events include, but are not limited to: hosting an auction, gala, marathon, golf event? if your nonprofit. Special Events Gaap.

From corporatefinanceinstitute.com

IFRS vs US GAAP Definition of Terms and Key Differences Special Events Gaap federal tax issues. Special events, in this context, are synonymous with fundraising events such as galas (most. some popular types of special events include, but are not limited to: if your nonprofit follows generally accepted accounting principles (gaap), special event revenue should be reported on financial statements. if your organization adheres to generally accepted accounting principles. Special Events Gaap.

From store.lexisnexis.co.za

Gripping GAAP 2022 / 23 LexisNexis SA Special Events Gaap if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. hosting an auction, gala, marathon, golf event? however, accounting for special events can be tricky from a gaap and a tax point of view. federal tax issues. While fundraising is an integral part of many nonprofits’ finances, accounting for these. Special. Special Events Gaap.

From www.vskills.in

Certified GAAP Professional Vskills Special Events Gaap if your nonprofit follows generally accepted accounting principles (gaap), special event revenue should be reported on financial statements. Special events, in this context, are synonymous with fundraising events such as galas (most. While fundraising is an integral part of many nonprofits’ finances, accounting for these. federal tax issues. hosting an auction, gala, marathon, golf event? if. Special Events Gaap.

From www.youtube.com

Special purpose framework as per US GAAP I US CPA FAR Classes I Best US CPA Coaching In India Special Events Gaap Special events, in this context, are synonymous with fundraising events such as galas (most. if your nonprofit follows generally accepted accounting principles (gaap), special event revenue should be reported on financial statements. however, accounting for special events can be tricky from a gaap and a tax point of view. some popular types of special events include, but. Special Events Gaap.

From www.youtube.com

GAAP Concepts YouTube Special Events Gaap Special events, in this context, are synonymous with fundraising events such as galas (most. if your nonprofit follows generally accepted accounting principles (gaap), special event revenue should be reported on financial statements. federal tax issues. if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. some popular types of special events. Special Events Gaap.

From platteinstitute.org

Nebraskanomics A GAAP in Nebraska Budgeting Practices Special Events Gaap if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. some popular types of special events include, but are not limited to: Special events, in this context, are synonymous with fundraising events such as galas (most. hosting an auction, gala, marathon, golf event? While fundraising is an integral part of many nonprofits’. Special Events Gaap.

From learn.financestrategists.com

Generally Accepted Accounting Principles (GAAP) Finance Strategists Special Events Gaap hosting an auction, gala, marathon, golf event? Special events, in this context, are synonymous with fundraising events such as galas (most. federal tax issues. if your organization adheres to generally accepted accounting principles (gaap), you usually must report revenue. some popular types of special events include, but are not limited to: While fundraising is an integral. Special Events Gaap.